Finance your home improvements with Fortuna Home Solutions

Spread the cost of your windows, doors and conservatories with flexible, transparent finance options from FHS in partnership with Kanda – apply in minutes, get an instant decision and start paying only after your installation is complete.

Payment options

Financing your next home improvement with FHS is designed to be as straightforward as the installation itself. We understand that replacing windows, upgrading your front door or adding a new conservatory is a major decision, both emotionally and financially. That is why we offer a full range of payment routes, from traditional methods to modern finance plans delivered through our partner Kanda.

You can keep things simple with a one-off payment, spread the cost over a fixed period or combine a deposit with finance to suit your budget. Every option is clearly explained in plain English and there are no hidden fees from us. Our team will happily talk you through the choices, helping you find the approach that best fits your household and your future plans.

Whether you want to move quickly on an urgent project or take time to phase improvements room by room, our payment options give you the flexibility to plan ahead with complete confidence.

Cash

Credit and debit card

BACS and cheques

Finance plans with FHS x Kanda

Buy Now, Pay Later

Interest-free plans

Flexible finance for 2–10 years

Finance that gives you peace of mind

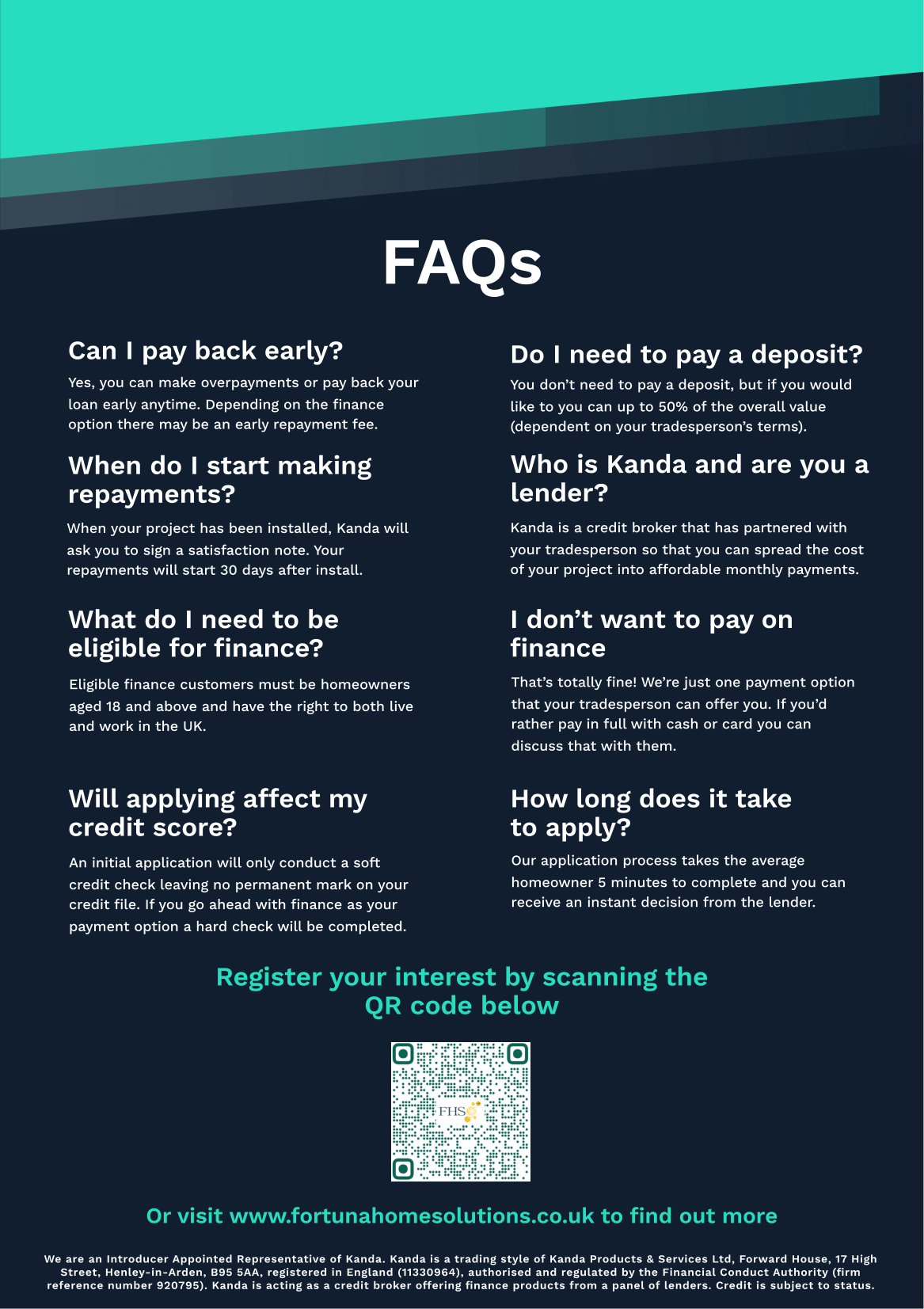

Our finance plans are designed to help you improve your home without putting pressure on your day-to-day finances. Applications are completed online through Kanda, using a secure form that normally takes around five minutes. You will receive an instant decision from the lender, and your initial application only uses a soft credit check, which means there is no impact on your credit score unless you choose to go ahead.

Once your project has been installed, we will ask you to sign a satisfaction note confirming that you are happy with the work. Only then do your repayments begin, typically 30 days after installation. Everything is handled transparently, with clear documentation so you always know the total amount payable, the length of your term and your monthly instalments.